Introduction

In April of this year, XRPL’s proposed new AMM feature received wide recognition for its proposed architecture that will include protocol-wide liquidity, CLOB integration, and what’s known as “continuous auctions”.

Since then, there have been two new exciting developments:

- XLS-38d: A pending decentralized bridging standard to connect the XRPL Mainnet with other chains and a particular focus on new XRPL sidechains, awaiting community approval. Critically, this will connect the XRPL Mainnet to the EVM sidechain.

- The EVM Sidechain: A parallel blockchain to XRPL, enabling Solidity-based developers to easily deploy on the network.

In this piece, I’ll cover both of the above with a particular focus on the EVM sidechain. It’ll be packed with information and is a must-read for anyone curious about the XRPL ecosystem.

I’ll then finish with an analysis that includes:

- Why the EVM Sidechain distinguishes itself from other EVM-compatible networks.

- The impact of XRP volume on XRPL’s growth and DeFi ecosystem.

- Key factors for developers considering XRPL or alternative platforms.

The XLS-38d bridge

Before diving into the EVM Sidechain, let’s explore the XLS-38d —XRPL’s pending decentralized asset bridge specification. Anticipated to be proposed in the coming months as an amendment to the XRPL validator community, this bridge serves as the conduit for transferring assets between the XRPL and its sidechains.

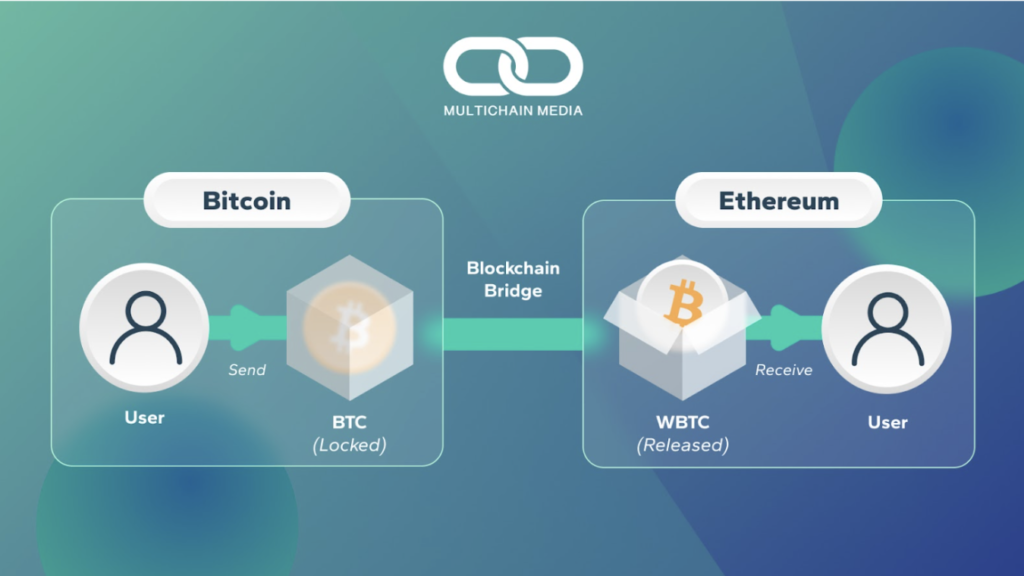

Bridges like XLS-38d operate as follows:

- Source Chain: Initiates a cross-chain transfer to the Destination Chain.

- Destination Chain: Receives the asset from the Source Chain.

Typically, tokens are locked on the Source Chain, and a corresponding representative version is minted on the Destination Chain. For instance, to acquire Bitcoin (BTC) on the Ethereum network, BTC is locked on the Bitcoin Network (Source and Locking Chain) and a version of Bitcoin (“WBTC”) is minted on the Ethereum Network (Destination and Issuing Chain).

In the XRPL ecosystem, a typical scenario might look like this:

- A user wants to transfer XRP from the XRPL Mainnet to the EVM sidechain.

- XRP is locked on the XRPL Mainnet.

- A representative version of XRP is minted on the EVM sidechain via the XLS-38d bridge.

This representative XRP can be used within the EVM sidechain and redeemed for native XRP whenever desired, facilitating seamless value and information flow across the XRPL ecosystem.

XLS-38d Security

While this is great, the most important factor in a bridge is security. This is because bridges were hacked for over $2B in 2022 and they’re a prime target for theft due to the sheer size of funds held by them.

Multiple Witness Servers together operate a bridge and attest that a given transaction is valid. They’re essentially oracles that provide proof that an event happened on either the locking chain or the issuing chain. When a witness server detects an event on a given chain, it creates an attestation (signed message) that’s shared with the other chain.

Developers can set up multiple Witness Servers in a multi-signature format. A transaction is approved as valid only if the majority of these servers agree, allowing developers to choose diverse yet trustworthy parties as Witness Servers to reduce attack vectors.

Bishop Fox, a leading offensive security firm, has audited the bridge with another audit anticipated. The Ripple team is working with them to address the findings and fix any bugs. This is not 100% secure as many DeFi projects have been exploited despite audits, but based on the credibility of both the RippleX team and Bishop Fox (who have a very extensive and credible history), I believe that it should be secure.

Sidechains

As mentioned, the XLS-38d bridging standard is the enabling technology for bridging assets between the XRPL Mainnet and other chains. The main focus is to enable bridging between XRPL Mainnet and XRPL sidechains. For context, a sidechain is an independent ledger with its own features. This includes its own consensus design, transaction types, network rules, and so on. It can be thought of as an individual blockchain that runs parallel to a mainchain and allows value to move freely between the two.

While the XRPL mainchain has many strengths, developers can pursue a greater variety of use cases by deploying customizable sidechains for purposes such as:

- Smart contract execution: new smart contract execution environments powered by other virtual machines, such as the EVM, Move VM, or Web Assembly.

- New assets: such as decentralized stablecoins with innovative features.

- Permissioned networks: such as private networks for institutions, with assets being tradeable on the XRPL Mainnet

- Permissionless networks: open networks, like the EVM sidechain, with assets being tradeable on the XRPL Mainnet.

The EVM sidechain is a perfect example of the above, as it’s a permissionless network that benefits from the EVM with new assets. Beyond this, higher throughput (by reducing demand for XRPL block space) and interoperability (via XLS-38d connectivity to other sidechains) are the other core benefits of a sidechain.

Now that this is covered, let’s take a look at the actual EVM sidechain itself.

XRPL’s EVM Sidechain

Ethereum runs the Ethereum Virtual Machine (EVM), which can be thought of as a global computer that stores a state, whereby everyone can simultaneously see a snapshot of all accounts and smart contracts at any given moment in time. While developers can deploy applications on Ethereum, they often choose to instead deploy on EVM-compatible networks like Avalanche or Binance Smart Chain. The reason for this is that they can benefit from the unique characteristics of a given network, such as lower fees, faster block times, or specialized use cases.

The XRPL EVM sidechain is an example of this and has been developed by Peersyst. It allows developers to deploy applications written in Solidity, the most popular blockchain programming language (with over 200,000 developers), and in turn benefit from Ethereum’s vast set of resources. At the same time, the EVM sidechain benefits from the various characteristics of a given network, such as lower fees, faster block times, or specialized use cases.

By building an EVM sidechain and a bridge that connects to it, the XRPL ecosystem becomes much more easily accessible to a broader audience of developers. These developers can in turn benefit from its technical features such as high speed, low-cost transactions, or from ecosystem benefits such as connectivity to the various global institutions reliant upon the XRPL. They also benefit from the highly liquid nature of XRP, which is represented as the token eXRP on the sidechain.

At a technical level, the sidechain relies upon the Cosmos SDK. I’m a big fan of Cosmos and their SDK is renowned for being top-notch. The SDK includes Comet BFT, a replication machine that essentially ensures that different servers (or, sidechains in this case) all agree on a common state. Beyond this, block time is 3.4 seconds per block, much faster than Ethereum’s ~14 seconds.

It’s also important to note that the XRP on a given sidechain would be a representation , and therefore be represented as eXRP instead of as XRP itself. This is not an issue, it just reflects the fact that assets are locked on the XRPL mainchain itself in order to facilitate bridging.

Thoughts on the EVM Sidechain

According to DeFiLlama, there are 120 EVM-compatible blockchains. So does it matter that we now have yet another, connected to the XRPL?

In my opinion, yes.

First, let’s consider volume and network effects. XRP has an immense trading volume that’s rarely below $1 billion on any given day. This will only grow in my opinion, considering that

- 5 countries are already building CBDCs on XRPL,

- Banks and financial companies drive volume on Ripple’s on-demand liquidity,

- Blockchain remains nascent

- We are in an ongoing bear market.

Given the extent of countries, institutions, and consumers that will be increasingly using the XRPL, new developers can launch new projects and build their brand and utility around XRPL’s liquidity. An interesting example includes HomeCoin, a mortgage-backed stablecoin on the XRPL. Other examples might be based on either existing or upcoming capabilities (such as decentralized identity, XRPL’s central limit order book, or NFT transactions). They could also include novel use cases, such as borrowing/lending protocols centered around XRP liquidity, or cross-border remittances.

Second, let’s consider their DeFi. The number of DeFi applications incorporating XRP is growing steadily, with an increasing amount of XRP locked into smart contracts on leading DeFi applications like PancakeSwap and Venus. PancakeSwap alone has over $2.7M in total-value-locked (TVL) in an XRP/WBNB pool. This XRP is on the BSC network, so the hope is that the EVM sidechain will attract any XRP that’s sitting on external networks, such as BSC or Ethereum.

XRPL’s DeFi is in its early phases but emerging quickly, with many projects such as Orchestra Finance attending their Apex Summit in September. Given that XRP is a global asset, its ability to connect to the Ethereum community is important in making it borderless within the blockchain as well, so the EVM sidechain should only be of net benefit to their DeFi.

Source: https://www.stedas.hr/xrpl-ecosystem/xrp-ecosystem-poster-pre-order-2.html

Last of all, I expect that moving forward there will be additional sidechains that are complementary to the XRPL Mainnet, and increase the size of the pie for the XRPL ecosystem. This in turn increases the network effects that benefit the EVM sidechain, and ambitious DeFi developers can especially take advantage of XRPL’s expanding ecosystem, as the EVM sidechain provides them with an opportunity to launch new projects and build their brand & utility around XRP liquidity. This is not a trading strategy – it’s simply enabling developers to get as creative as they desire with XRP.

Should Developers Build on the EVM Sidechain?

Attracting developer talent is one of the biggest challenges faced by blockchain ecosystems. To do so, they often compete via lucrative grants and incubators, strong developer tooling, and promises of ecosystem growth. The result is that any developer currently in Web3 or considering the transition has a myriad of options available.

I see a few reasons to consider building on the EVM Sidechain:

- XRPL Ecosystem: The EVM sidechain is effectively a new chain that’s part of the XRPL ecosystem. Developers therefore have a first-mover advantage in an ecosystem that’s much less saturated than Ethereum, and a great idea could go a long way.

- Network Effects: XRP has a massive following, and yet the XRPL is only beginning to grow. By working alongside both the biggest global institutions and actual countries, the sheer potential of building a solid product on the XRPL is immense. And as the XRPL continues to develop, it may be easier to amass a following compared to other nascent Layer-1s.

- Ethereum Familiarity: Not all Ethereum-based developers may feel prepared to build on the XRPL Mainnet. The EVM Sidechain is an easy way to become familiar with the XRPL ecosystem while benefiting from familiar tools and languages.

- Security: The XRPL has been in operation since 2012, without any breaches or major incidents (a rarity in blockchain). The XLS-38d bridge is also built to live up to this high standard, making the network quite secure.

- Regulatory Clarity: XRP being considered not-a-security is a competitive advantage over other blockchain networks.

That being said, there are some downsides:

- Competition: There are some really solid blockchains out there that are connected to Ethereum, meaning they benefit from its network effects. By building on a network connected to Ethereum, it may be easier to tap into the EVM ecosystem’s liquidity and grow TVL more quickly.

- Adoption: The XRPL’s on-chain developer activity has lagged behind other ecosystems, and is a late mover in DeFi. The network will also need to draw in useful infrastructure projects and end users in order for developers to succeed.

The XRPL might not be best suited for everyone, but anyone curious about it would likely find value in learning more. I’m also sure that the RippleX team would be able to provide feedback surrounding potential innovations, and that great ideas might not be far away.

Conclusion

In summary, the XRPL EVM sidechain will allow developers familiar with Solidity to easily build projects that have connectivity to the XRPL Mainnet and other sidechains. This should open up the door for widespread innovation as developers create novel use cases built around XRP’s liquidity. In turn, as more countries, institutions, and consumers begin to increasingly adopt the XRPL, this could have a huge payoff for those able to provide value to the ecosystem.

This will all be enabled through the XLS-38d bridge, which will be live for voting in the near future.

If you’ve made it this far – congrats! And thanks for reading.

And if you are interested in building on the XRPL, feel free to book a call using my Calendly.

Lachlan Todd