Hi there!

This is my first piece, and I’m doing it in-part for fun, and in-part as an entrance into sharing with the public some of the cool things I’ve learnt while working in DeFi.

Today I’ll be going over www.defillama.com, an amazing website where one can view the Total Value Locked (TVL) amongst various blockchains, and the protocols within those protocols. I’ll go over the various lingo, how to navigate the site, and explain some ways to use the data. This is just a general intro but I’m happy to dive further into a topic — just let me know in the comments or reach out via DM (Twitter: LT_DeFi_Doink)

First of all — what the heck is TVL? Total Value Locked is the amount of user funds deposited in a decentralized finance (DeFi) protocol. If you’re new to the world of DeFi, I suggest you do some light reading, and I’ll make a post about it later. It can generally be seen as a proxy for how influential/popular/healthy a particular protocol here. TVL blasted off in 2020 in what became known as “DeFi Summer” but has tapered off in recent months with the crash of Luna and the general decline in crypto / macroeconomics.

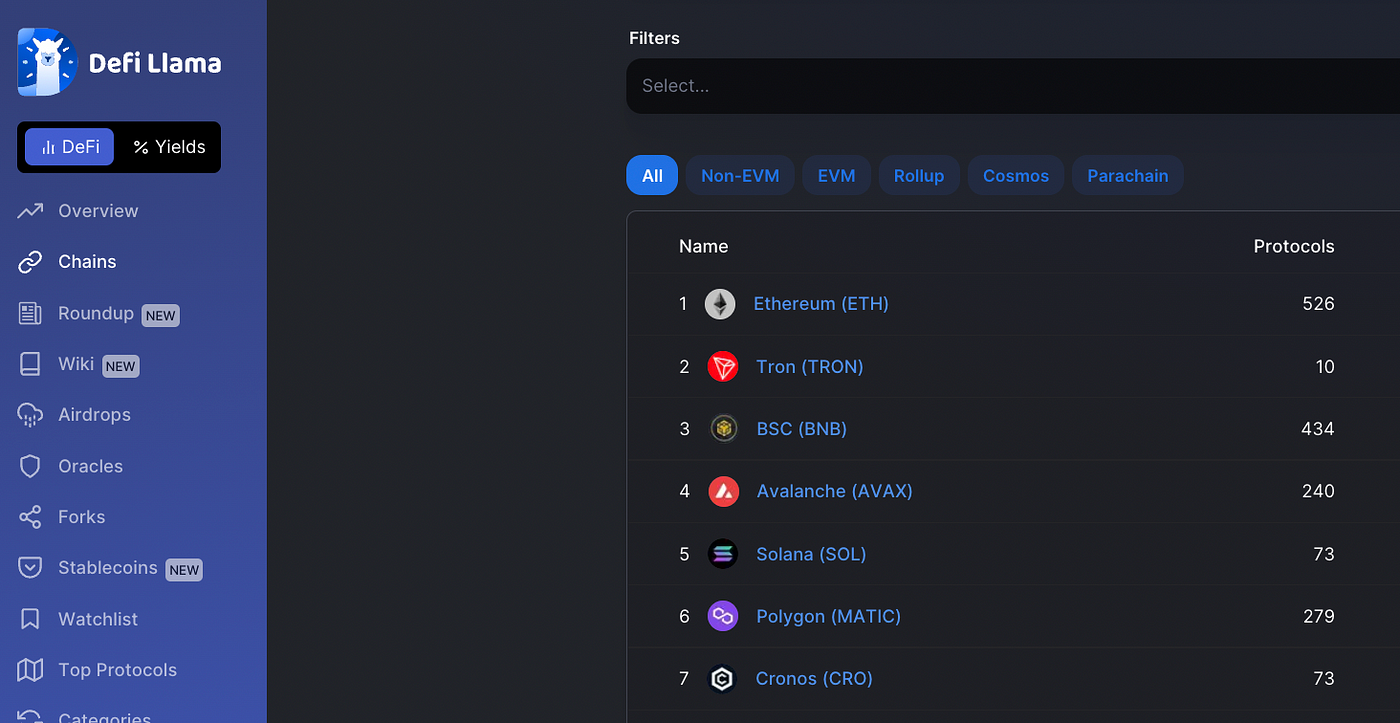

If I click on “Chains” along the side of the site, I can see that Ethereum has the most TVL, with $39.56B locked as of August 2, 2022. Tron, BSC, Avalanche, and Solana follow.

If I actually click on Ethereum, I see the following:

MakerDAO is the largest protocol within Ethereum, with a TVL of $8.39B. This has increased 7.03% in the past month, likely because of the fact that they manage DAI stablecoin, and stablecoins have been increasing in popularity given their stability compared to the rest of the crypto assets (e.g. investors ditch risky assets for stablecoins).

What about the chains column?

The left-most symbol is the blockchain where the protocol initially started (e.g. is native to). So if we were on the Solana blockchain page, despite seeing Lido on that page, we’d note that Lido was in fact started on Ethereum.

If you go to the Chains tab, you can also sort by types of chains such as EVM, non-EVM, Rollup, Cosmos, and Parachains (while viewing how many protocols exist within each).

EVM refers to Ethereum Virtual Machine. In my line of work, we enjoy working with EVM Chains because we’ve already written data scripts using Solidity and Golang SDK, whereas non-EVM Chains may require custom work. Learn more about EVM here.

You can learn about rollups and sidechains here. Also let me know in the comments if you’d like me to dive deeper on them, or any other topic.

Stablecoins

Stablecoins are my specialty, and I often use DefiLlama for finding data about them on various blockchains. After clicking on the stablecoins tab, we can see that the total stablecoin market cap is $153.68B. Note that this might vary by site, as not all sites monitor the exact same blockchains and may have conflicting information but it gives a good overview.

We can then click on any blockchain to see which exist within them. I’ll be creative and not pick Ethereum this time, let’s look at Evmos (a Cosmos-based Chain I’ve been personally interested in in recent times.

There are only 5 stablecoins and we can see that all except USDT are native to Ethereum. That being said, they might have been “natively issued” on additional blockchains such as Evmos, but further research would be required to confirm this.

What does natively issued mean? It means that the stablecoin actually exists rather than its representation. For example, USD Coin (USDC) receives grants from blockchain foundations to actually launch the blockchain within their ecosystem. In contrast, a wrapped stablecoin means that smart contracts are being used to represent the asset on a chain where it doesn’t actually exist. In the context of buying Bitcoin within Ethereum, you’re not buying true Bitcoin, you’re buying the ERC-20 version of Bitcoin that tracks the real Bitcoin price. Wrapping tokens of course exposes security risks through bridges and this has been exploited in many recent times.

Did I get distracted? Anyways, we can see that there are 5 stablecoins lauched within Evmos, and we can see their various characteristics such as their Market Cap, etc (BUSD looks barely existent).

Downloading Data

For certain pages (e.g. not stablecoin pages, but on Chain pages) you can download CSV files of all the data. Just look for the small csv button. It seems to come out messy and might need some cleaning, as it might provide data for every single day in history and in a transposed format. That being said, it could be useful for running analytics on patterns.

Historical Data — Rug Pulls?

I’m not going to give any concrete examples but if you click on a protocol, you can see a chart of their historical TVL data. You might note that in recent times, there’s been a drop due to challenges faced within the world of DeFi, such as the TerraLuna collapse that spooked investors and caused an outflow of cash. You might also notice that some protocols gained massive TVL in a short amount of time, and then quickly crashed. One common reason for this is that protocols may give generous token rewards to encourage users to flock to their protocol, in a sort of bootstrapping that’s (hopefully) meant to keep users long-term. However, users often cash out and leave, causing the TVL (and likely the token price too) to crash and slowly dwindle. It might still be a good project, or it might also have just been enticing users through nice rewards (and at worse, a rug pull).

Conclusion

Defillama is a great site for exploring what’s happening in the world of Decentralized Finance. You can view what’s happening by various chains, download this data to run your own analysis, view stablecoin data and trends, and some other functionalities I didn’t get into (e.g. viewing airdrops and forks).

I frequently use the site in my own line of work to track emerging protocols, shifts in momentum, see which blockchains have thriving DeFi ecosystems, and more.

1 Comment

Comments are closed.