Stablecoins are the backbone of DeFi. And while USD-backed stablecoins are now quite mature and represent an enormous share of the cryptocurrency market, it’s crypto-collateralized stablecoins that are experiencing the most rapid innovation.

The intent of this article is to educate users about stablecoins as a whole, before narrowing down on crypto-collateralized stablecoins.

We’ll examine how they work, their pros and cons, some cool projects such as Origin Dollar and QiDao, and what we can expect moving forward. By the end, users should have a significantly enhanced view of crypto-collateralized stablecoins and their future trajectory.

Stablecoins

Stablecoins are a type of cryptocurrency designed to maintain a stable value compared to a specific asset or a basket of assets, most commonly the of U.S. Dollar.

Why might this be relevant? Stablecoins have a huge array of benefits:

- Store of Value: countries with high levels of inflation and/or currency controls commonly turn to stablecoins as a means of preserving their wealth. For example, stablecoins are becoming increasingly popular in Argentina.

- Bridging Liquidity: stablecoins are great for connecting fiat and crypto, as it’s preferable to hold one’s wealth in a stable currency (rather than BTC, ETH, etc) while waiting to deploy funds. Furthermore, stablecoins bridge liquidity between blockchain networks and DeFi protocols. An example would be sending USDC from Avalanche to Polygon.

- Payments/Remittances: high speeds and low-fees make stablecoins well suited for cross-border remittances and payments. I expect that many businesses will begin accepting stablecoins in the future for these reasons (pending relevant regulatory decisions).

- Stable Asset Pairs: DeFi often requires a stable asset against which to price a trade, as pricing trades against BTC/ETH etc would not be optimal. This is a major reason that securities-focused blockchain Polymesh launched their own stablecoin.

That being said, different types of stablecoin architectures exist and each one has its own unique characteristics and trade-offs.

This piece will begin by providing an outlining of the three major types of stablecoins, before diving deep into crypto-collateralized stablecoins.

Types of Stablecoins

For simplicity’s sake, I will be referring to USD-pegged stablecoins which are most common. Other stablecoins such as the Euro Coin are growing but still pale in comparing to USD-denominated stablecoins.

There are three main types of stablecoins:

Fiat-collateralized

Fiat-collateralized stablecoins stay pegged to the USD by holding real USDs (or cash equivalents, such as T-Bills) in legal custody, for which the stablecoins are redeemable. The result is that firms must establish these legal processes and as such stablecoins are issued by centralized firms. They’re also commonly referred to as USD-backed stablecoins.

Benefits include price stability, banking integrations that enable easier bridging to DeFi, and legal compliance. In contrast, downsides include centralization and trust in the banking system (which led to a price depeg when USDC’s bank SVB collapsed).

USD-denominated stablecoins dominate, with USDC, USDT, and BUSD having a combined market cap of $121B at the time of writing.

Crypto-collateralized

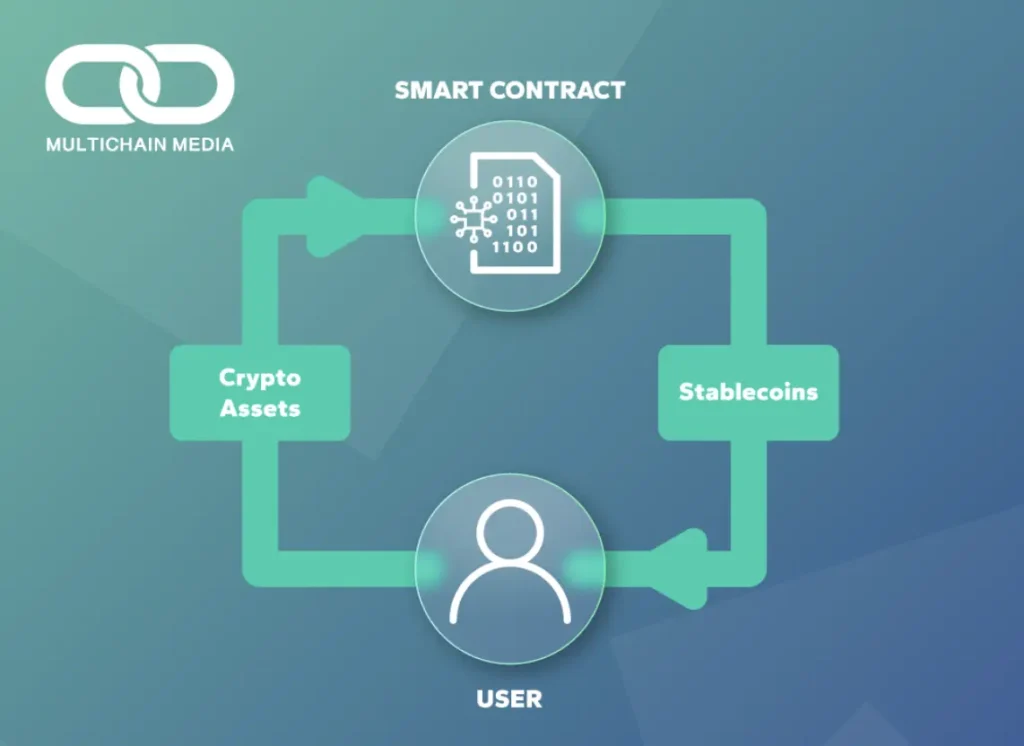

Crypto-collateralized stablecoins are backed by other crypto assets as collateral.

While fiat-collateralized stablecoins are great, many blockchain maxis are adamant in wanting decentralized options. It turns out that by using one’s crypto assets as collateral, it’s possible to create (“mint”) USD-pegged stablecoins. This means that users can benefit from any potential upside price action on behalf of their collateral while gaining access to liquidity in the meantime. For example, by depositing $1,000 of ETH, one could mint $600 worth of crypto-collateralized stablecoin DAI.

The downside here is that due to volatility in the cryptocurrency market, these stablecoins must be overcollatearlized which leads to capital inefficiencies and potential liquidations.

DAI, FRAX and LUSD are three of the most popular crypto-collateralized stablecoins with a combined market cap of ~$6.6B at the time of writing.

Algorithmic

Algorithmic stablecoins vary in their designs and may or may not have reserves. One significant distinction is that an algorithm, which is a computer program that adheres to a predetermined formula, controls the stablecoin’s supply and demand. One example of this might be a subcategory of algorithmic stablecoins known as “rebase stablecoins” whereby supply is dynamically changed to maintain price stability.

While algorithmic stablecoins are great in theory, they only work until they don’t anymore. Terra Luna’s infamous collapse in May 2022 wiped out ~$60B in value from their algorithmic stablecoin UST and associated token LUNA, as both crashed to zero.

Now that we have a good overview of the stablecoin landscape, let’s take a closer look at crypto-collateralized stablecoins.

Crypto-Collateralized Stablecoins

To understand the emergence of collateralized stablecoins in the context of decentralized finance (DeFi), we need to go back to the early days when DeFi was not yet a widely recognized term and Ethereum-based applications were just starting to gain traction.

DeFi protocol MakerDAO was one of the pioneers in this space, creating a unique system that allowed users to generate DAI stablecoins by locking up Ether as collateral. While an obvious invention in hindsight, this revolutionary concept laid the foundation for the development of further crypto-backed stablecoins and played a crucial role in the growth and evolution of the DeFi ecosystem.

Not Familiar With DeFi Jargaon? Well! Try Reading Our Most Comprehensive DeFi Glossary.

What are crypto-collateralized stablecoins and how do they work?

Earlier I used the example that by depositing $1,000 worth of ETH, one could mint $600 worth of DAI stablecoin. DAI is MakerDAO’s stablecoin, and in this specific example, the loan in DAI would have a collateralization ratio of 167%.

One could then take their DAI stablecoins over to other DeFi applications, such as borrowing/lending platforms like AAVE, in order to seek additional yield. For example, DAI could be lent out via AAVE for a loan in ETH, which could then be used to take out more DAI. In contrast, one could also simply pay off outstanding loans of theirs while expecting that ETH’s price might increase.

Example: a user deposits ETH into MakerDAO (a smart contract) and receives DAI in return.

However, if the value of the collateral decreases significantly, the user’s position may be liquidated, and they may not have access to their collateral. For instance, the most liquid vault in MakerDAO requires a minimum collateralization ratio of 145%. If the ratio falls below that level, the user’s position may be liquidated.

MakerDAO initially only accepted Ether as collateral, resulting in a single collateral DAI (known as SAI). However, as the protocol expanded, more cryptoassets were added as collateral, and it was renamed to multicollateral DAI.

Today, DAI’s collateral is composed of various asset types, including fiat-backed stablecoins, real-world assets, and liquid staking derivatives. This broad range of collateral types increases the stability and diversification of the DAI stablecoin. In fact, they are the largest revenue generator of any lending platform, and derive 60% of their revenue from real-world assets.

LUSD and FRAX

Two other big players worth mentioning are LUSD and FRAX.

Liquity’s stablecoin LUSD offers some of the most attractive borrowing conditions in the market, including a 0% interest rate and a collateral ratio of just 110%. One of its unique features is that it allows users to participate in a revenue-sharing program related to liquidations on the platform, unlike MakerDAO. Liquity’s decentralized protocol is also censorship-resistant, giving users complete control over their assets.

FRAX is as an fractional-algorithmic stablecoin, referring to the fact that it’s partially backed by a fraction of USDC and that this fraction algorithmically changes. For example, when its “collateralization ratio” is 98%, then new FRAX may be minted by depositing $0.98 of USDC and $0.02 of FRAX’s governance token FXS. The algorithm is used to help maintain price parity of $1.00. In practice, if the price of FRAX were to drop to $0.97, then the collateralization ratio would increase to provide more confidence in FRAX. Additionally, one could buy it for $0.97 on the open market and then redeem it for $0.98 USDC and $0.02 FXS (assuming CR is still at 98%), then sell for profit. The same works in reverse, and while some other details exist, this essentially is how FRAX maintains a price of $1.00.

FRAX is one of the most successful examples of an algorithmic stablecoin, although of noteworthiness is that they in fact underwent a governance vote on February 22nd to become fully backed by USDC.

Although these three stablecoins may not yet have achieved the same level of widespread adoption as fiat-backed stablecoins such as USDT or USDC, they have managed to carve out a niche for themselves in the rapidly evolving world of DeFi. By utilizing the power of blockchain and smart contracts, these projects have been able to create robust, decentralized assets that aim to maintain USD parity.

Innovation in Crypto-Collateralized Stablecoins

Crypto-collateralized stablecoins are one of the areas of DeFi that are likely to see the greatest innovation in the coming years. Fiat-backed stablecoins are hard to innovate upon as they’re backed by cash or cash equivalents and subject to regulatory hurdles. In contrast, DeFi protocols are continuously innovating on how they revolutionize the concept of an decentralized stablecoin backed by on-chain assets.

In the opinion of Multichain Media, this space will see big innovation throughout 2023 and 2024. Established models like MakerDAO’s DAI and FRAX will remain ahead, but new projects will compete for market share through exciting new architectures.

Even if projects don’t innovate in stablecoin functionality, many are creating their own in order vertically integrate such as Aave and Curve who have both introduced their own stablecoins. This is being done in order to have greater monetary policy influence over their protocols and to accrue greater value to their tokens.

Innovation-wise, a few interesting examples include:

Reserve Protocol

As more real-world assets arrive on-chain through tokenization, Reserve is enabling anyone to propose their own stablecoins backed by a combination of these assets. For example, one stablecoin might be 30% tokenized real estate, 30% USDC, 20% gold, and 20% bonds. The result is a new form of currency that accrues value to it and is inflation-resistant. Check out our overview of them here, and our piece describing six use-cases of them here (p.s. they came 2nd and 5th in Reserve’s hack-a-thon).

QiDAO

This is a stablecoin protocol that allows users to mint their decentralized called MAI by taking overcollateralized debt positions using crypto assets (similar to MakerdDAO). The protocol ensures that the value of MAI is pegged to within 1% of the US dollar, and unlike MakerDAO, no interest is charged on the loan. However, when the debt is repaid, a 0.5% repayment fee is charged (similar to LUSD),

QiDao has been working diligently to expand the availability of its stablecoin to various blockchain networks, resulting in its successful integration with over 11 EVM-compatible chains to date. Being multichain is one of their big advantages over other decentralized stablecoins and how they are differentiating themselves.

Origin Dollar

OUSD is a stablecoin 1:1 backed by other well-established and secure stablecoins like USDT, USDC, and DAI. This ensures that its value maintains a close peg 1 USD.

The underlying stablecoins generate yield for OUSD through deployment onto various DeFi protocols, primarily Morpho and Convex Finance. Collected interest, trading fees, reward tokens, and so on are pooled together and converted to OUSD.

Therefore while it remains pegged to $1 USD, the amount that a user holds grows over time as yield is generated. These returns are passed on to OUSD holders through constant rebasing of the money supply. It’s sort’ve like automatically generating yield on one’s cash, albeit with a higher return than a bank’s savings account.

Conclusion

Stablecoins have become a critical component of the cryptocurrency ecosystem, providing users with a way to transact with digital assets that have predictable values. Among the different types of stablecoins, collateralized stablecoins, which are backed by assets held in reserve, have become increasingly popular.

For every conference that Multichain Media attends, there are at least 5+ Founders of decentralized stablecoin projects who are met. This is one of the fastest growing areas of DeFi, with a huge array of innovation happening.

This article provided an overview of crypto-collateralized stablecoins and how they compare to other stablecoins models. We then examined some interesting project examples, such as Origin Dollar and Reserve Protocol, and discussed what the future of this space might look like.

As the industry continues to mature, we can expect to see the emergence of new stablecoins such as GHO, the AAVE stablecoin, and CRVUSD, the Curve stablecoin. There is no doubt that stablecoins will remain a hot topic in the near future as they continue to gain traction and adoption within the broader cryptocurrency ecosystem.