In doing my personal research I found that decentralized finance (DeFi) glossaries of key terms are either outdated or lack the inclusion of relevant industry terms.

Below is the most comprehensive glossary of decentralized finance terms that I hope will help the reader learn about new terms and topics that might be unfamiliar. Most of these are quite common in the space and are great to be familiar with.

Enjoy!

Airdrop

An airdrop is a method whereby projects distribute tokens to a large number of wallet addresses at the same time. It’s usually done for free, and as a way to reward followers and to encourage the usage of their project. For example, Aptos recently distributed 150 $APT tokens ($900 at the time of writing) to community members as a way to reward those that had been involved in their project early. Many Twitter accounts explore ways to receive potential upcoming airdrops, or report announced airdrops. Cosmos Airdrops is an example.

Automated Market Maker (AMM)

Refers to a smart contract that automatically adjusts pricing on decentralized exchanges. Liquidity reserves are therefore managed by the AMM and users can trade against these reserves (“pools”) using prices that are set by an algorithm. In the context of the most popular decentralized exchange UniSwap, the constant product function X * Y = K is used for pricing.

It basically says: if a given asset (“X”) becomes more abundant in a given liquidity pool (which I define later on in this glossary) than another asset (“Y”), the price of each becomes adjusted so that K remains constant.

So if I trade a lot of Token X for Token Y, there’s now more Token X in the liquidity pool. Token X’s price is adjusted downwards, until arbitrageurs trade the opposite way for profit, bringing Token X’s price back to equilibrium in relation to pricing from external sources such as other decentralized exchanges.

Collateralized Debt Position (CDP)

CDPs were first popularized by MakerDAO which is the 2nd largest DeFi protocol as measured by TVL. The way that it works is users can use their cryptocurrency assets as collateral in order to take out a debt position, in a quick and decentralized manner.

If I have $10,000 in Ethereum, I could go to MakerDAO and instantly take out a loan in the form of their crypto collateralized stablecoin $DAI. I’d likely want to take out a loan of $6,000 DAI or less in order to avoid being liquidated in the event that Ethereum drops 40% or more, which would mean my collateral is worth less than my loan. Typically, CDP platforms liquidate you once your collateral-to-loan reaches a certain ratio, and charge a liquidation fee which goes towards those that execute the liquidation.

Certain protocols automatically manage your loan to avoid outright selling off your entire collateral, whereas other protocols require users to be be weary and manage their positions themselves. Liquidations were one factor contributing to crypto’s downward spiral in 2022. Other popular CDP projects include Liquity and QiDAO.

Centralized Exchange (CEX)

This refers to a crypto exchange that’s centralized, meaning that it’s a single entity or organization managing it. Examples include CoinBase, Binance, or the recently fallen FTX.

They tend to aggregate and simplify various services such as buying/selling cryptocurrencies, swapping assets, staking, and more. They also have large liquidity networks and economic power meaning they can providing good pricing. However, they also hold customer funds in their possession and may be subject to counterparty risks, as was seen with FTX. Many are regulated, but some operate in jurisdictions with fewer regulations, and users should therefore be weary of their CEX provider should they choose to use one. I personally use Binance for buying crypto, but then withdraw it to my MetaMask in order to remain in control of my funds.

Contract Address

A unique blockchain address associated with a given smart contract. Every decentralized application, which rely on smart contracts, has its own unique contract address associated with their token. This lets blockchain wallets know exactly which token you are referring to.

Centralized Finance: CeFi, also known as TradFi, refers to

Composability

This refers to the ability for decentralized protocols to easily integrate and communicate with one another. A project or platform is composable if it can be used as “lego” building blocks for other applications, making the job of developers much simpler. Within Ethereum, projects are very composable as they can all interact with one another using Ethereum’s Virtual Machine (EVM). This is also important in making blockchain interoperable as a whole, because with a huge rise in the number of blockchain networks, there’s a need for them to be able to communicate and transfer value or information amongst one another.

Decentralized Application (dApp):

These are decentralized software applications built upon blockchain networks. They rely on smart contract code (which I explain later on) to automatically execute computer code based on user input. DeFiLlama lists 2,000+ dApps at the moment, with the most popular five being MakerDAO, Lido, Aave, Curve, and UniSwap. One example of dApp functionality would be a decentralized exchange (such as Curve or Uniswap) that lets users swap assets in a decentralized manner, meaning that no centralized party is needed for the trades to execute. This contrasts with providing custody of my funds to Binance and using their platform and liquidity networks to swap assets. Another example is Lido, which specializes in liquid staking, a term I explain later on.

Decentralized Autonomous Organizations (DAOs)

DAOs are a new ideology of how an organization might organize itself. Under a DAO, there is no centralized leadership. Instead, it’s a collectively owned and managed organization that works together towards a collective vision. Coordinating like-minded folks from around the globe can be very powerful if done properly, and these DAOs tend to have treasuries that are collectively managed. Governance processes are followed to ensure that voices are heard and the majority are in agreement, and everything is done transparently on-chain. One potential downside is the requirement of fast decision making during times of crisis (such as the collapse of Luna’s UST), although DAOs may have emergency procedures in place.

Aragon, providing open-source DAO infrastructure for projects, has become very popular. They have great resources if you’d like to learn more about DAOs.

Decentralized Insurance

Currently, decentralize insurance protocols such as Nexus Mutual are mainly limited to on-chain risks at the moment, such as smart contract vulnerabilities. Slowly, more off-chain risks are being insured, such as ACRE Africa working to provide drought insurance to Kenyan farmers.

Decentralized Exchange (DEX)

Many, but not all, decentralized exchanges rely on AMMs for establishing asset prices, which I detailed above. A DEX contrasts with a CEX in the sense that it enables anyone to swap assets without relying on a centralized entity to conduct such trades, and that it does not actually custody customer funds. It’s essentially just computer code that prices assets automatically so that users can trade.

Example: rather than trading $USDC for $ETH using Binance, I can go to UniSwap and do this. If I wish to trade two similarly priced assets, such as $USDC to $USDT, I would instead want to use Curve which uses a different pricing curve and is preferable for stableswaps.

Where does this liquidity come from? Liquidity pools, which I describe in further detail below. Essentially, liquidity providers deposit two tokens into “pools”, which others can trade using. AMM’s price the tokens, with arbitrageurs keeping prices at equilibrium. So if a given liquidity pool is ETH/BTC, then those with ETH could use it to swap to BTC, or vice-versa.

Typically a small fee is paid for every transaction, which provides a return to the liquidity providers.

Flash Loan

These enable one to take out a large loan for a blockchain transaction, as long as it’s repaid in the same transaction. It’s commonly used by arbitrageurs who can execute much larger and more profitable trades based off of small price discrepancies. However, flash loans have also been used by malicious parties who can manipulate markets and take off with funds. Remember how I explained that liquidity pools may change price based upon a pricing function? A large trade via a flash loan may therefore be used to manipulate prices in order to exploit a protocol.

CoinMarketCap provides a good overview of flash loan attacks.

Gas Fees

Blockchains need validators to maintain the integrity of the blockchain, order transactions, and so on. I describe validators later on. However, these validators also need financial compensation for their efforts, and this comes in the form of gas fees, which can be thought of as a network tax. It’s payable in the native token of a given blockchain, so ETH on Ethereum, MATIC on Polygon, SOL on Solana, and so on. Gas fees can vary depending on the date and time due to supply and demand. If a lot of people want to conduct transactions on Ethereum, gas fees increase.

Governance Token

These enable the holder to participate in the decision making of a protocol, and are most common in DAO’s. They’re kind of like shareholder votes in a traditional organization. In the context of DeFi, they’re most often used to vote on governance proposals, whereby changes to a protocol are suggested and then voted upon. MakerDAO’s $MKR token is an example, and $MKR holders can vote on important decisions such as the protocol’s minimum required capital amount for loans on their platform.

Impermanent Loss

This is a bit of a complicated topic and hard to briefly describe. When one deposits tokens into a liquidity pool in order to earn yield, the tokens may diverge in price from one another. For example, consider that I deposit funds into a liquidity pool comprised of ETH and USDC. If the price of ETH increases relative to USDC (which remains at $1.00), the liquidity pool would be rebalanced by arbitrageurs according the constant product formula that AMM’s like UniSwap use.

My proportionate share of the liquidity pool has now changed, and I’ve likely made some money. But if I had simply held my USDC / ETH and not deposited them, I would have made more from ETH’s price appreciation. The point is that volatile assets in liquidity pools can expose liquidity providers to a form of opportunity cost, which is impernanent until one’s tokens are withdrawn. I recommend checking out the Binance guide here which it explains it in more depth.

Layer 1

This is what comes to mind when one thinks of a traditional blockchain. It’s a decentralized ledger of data responsible for verifying transactions, and forms the base layer of a blockchain network. Layer 2 blockchains, decentralized applications, and all else are built on the foundations of a Layer 1. Examples include Bitcoin, Ethereum, Fantom, NEAR, and so on.

Layer 2

These are built upon Layer 1’s and their goal is to improve the performance and scalability of Layer 1’s. For example, Ethereum can only handle so many transactions per second, which results in high transaction costs for users, and prevents scalability.

Polygon, Arbitrum, and Optimism are examples of Layer 2’s built upon Ethereum. They have different methodologies for scaling, but basically they bundle a bunch of transactions together and send them to Ethereum as a single transaction that’s proven to be correct, thereby spreading out the cost of the single transaction amongst many. This process is known as a “Roll Up” and are different types are described in this glossary.

L2Beat is a great resource for data on Layer 2’s, and below you can see their types, which are terms I define in this glossary. Validium is best saved for another date and isn’t necessary to know.

Liquidity Pool

I already described these in the decentralized exchange section but I’ll do so again. Because decentralized exchanges enable trades without any intermediaries, the liquidity must come from somewhere. On the back end, there are “pools” of tokens that traders interact with to execute trades. Most commonly, these are formed by pairs tokens, such as ETH and USDC, although multi token pools also exist.

Those known as Liquidity Providers would deposit both ETH and USDC (or another pair of tokens) to form a big supply (“pool”) of tokens. Then when others use this pool to swap tokens, the pricing is automatically adjusted to incentivize arbitrageurs to trade the other way. So if I use an exchange to swap a lot of ETH for USDC, there’s now much more ETH than USDC, so ETH becomes priced lower, and arbitrageurs trade the other way to bring pricing back in line with market prices. The exact pricing mechanism depends on the particular AMM algorith. UniSwap and Curve have different pricing formulas, for example.

Liquidity Provider

Those that deposit tokens into a Liquidity Pool. They’re incentivized to do so because they receive trading fees in proportion to the amount of supplied tokens they deposited. On UniSwap, the fee to trade is 0.3%, whereas on Curve it is 0.04%. This is basically a way to earn passive income on one’s tokens by providing liquidity for others to trade upon.

Liquid Staking

I wrote all about staking and liquid staking in my piece here. I also describe staking in this document which might be useful to understand first. Staking is great for earning yield while helping to secure a network, but it locks up one’s funds which can be solved via liquid staking. Protocols such as Lido and RocketPool stake your tokens on your behalf, and in the meantime issue you receipt tokens that are redeemable for your staked tokens. These receipt tokens (“stETH” on Lido) thereby have value in themselves and are derivatives in a sense.

They’re compatible within their given blockchain networks, and can therefore be used for DeFi activities, such as using the tokens as collateral for a loan. Therefore, one can earn staking rewards while still having access to their capital. This is a big idea and has been gaining a lot of popularity, which is why Lido and other liquid staking protocols have grown so quickly.

Liquidity

This refers to the availability of cryptoassets that can be bought or sold, and the higher the liquidity, the less price impact that any DeFi trade will have. While traditional financial markets have global liquidity networks, a big challenge of DeFi is creating sustainable liquidity without intermediaries. Protocols with strong liquidity tend to be more popular due to their ability to execute transactions faster, cheaper, and more reliably. Tokemak is one such project aiming to improve how liquidity within DeFi functions — I love their team!

Liquidation

I described earlier how convertible debt positions (CDP’s) enable one to take out a loan using their crypto as collateral. Should their collateral’s price fall below a “liquidation threshold”, then their collateral will be sold off by liquidators and the borrower will be subject to a liquidation penalty.

For example, I might be required to have my collateral-to-loan ratio be 70%, so if I have $1,000 of ETH, I could only take out a loan of $700. If ETH falls down to a predetermined threshold, such as $750, I might get liquidated. Why not $700? Usually there’s a buffer that acts as incentive (meaning, a fee) for liquidators to conduct the liquidation.

Liquidations are a primary contributing factor to downward spirals during cryptocurrency declines, as high volatility leads to undercollateralized loans, which lead to liquidations, which lead to further price declines. Liquidation penalties are used to reward the parties that execute the liquidations and are typically 5–10%.

Mainnet

This is the main network used by a blockchain and the one that you’re using when interacting with any given blockchain such as Ethereum. It’s where real-world transactions take place, and where applications and services are built. A mainnet contrasts with a testnet, which is where testing is conducted prior to launching.

Native Token

This refers to a token that actually exists on a blockchain network. For example, BTC actually exists on the Bitcoin network. On Ethereum, it’s actually wrapped Bitcoin (WBTC), meaning it’s a wrapped token that tracks the price of Bitcoin. So BTC is native to Bitcoin network, SOL is native to Solana, ETH is native to Ethereum, and so on.

If you go to CoinMarketCap, you’ll note BTC is ranked #1, whereas WBTC is #19. WBTC is created by having a third party (BitGo in this case) custody one’s Bitcoin on the Bitcoin network and then issue WBTC on the Ethereum network (or another network) once confirmed. Other methods of “wrapping” tokens cross-chain exist, such as smart contract bridges.

Sometimes it can be confusing to know if a token is wrapped or not. $USDC natively exists on many blockchains, but on others it is wrapped, such as Axelar Network’s wrapped USDC (axlUSDC). Its title of axlUSDC provides a clue.

Proof-of-Stake

Many resources online already describePoS and here I’m going to recommend you check out Ethereum’s guide if you are curious to learn more. Or my my piece here!

In this glossary I define validators and staking, both of which relate directly to PoS and are necessary terms to grasp. At a high level, PoS is much more energy efficient than Bitcoin’s Proof-of-Work and is by far the most popular consensus mechanism used. There can at times be challenges, such as security risks for newer PoS blockchains who have less value staked, and are therefore more easily corruptible.

Oracles

These are extremely important to DeFi and are an important concept to understand. Given that blockchains are simply distributed ledgers, information is not actually native to them and must come from somewhere. We can’t simply trust a single party to say what the weather is or what a stock’s price is at any given moment. Instead, we need a trustless manner to reliably get real-world information onto the blockchain.

How might this work? One way could be that parties stake an oracle protocol’s token. They then aggregate data (e.g. what’s the price of this derivative?) from their various data sources and propose an answer, and all answers are then aggregated for a definite answer (e.g. $1,230.23). Those that are incorrect beyond a given range might be penalized.

Two popular oracle types are:

- Price-feed oracles: these convey real-time data of assets or commodities to smart contracts and are commonly used for lending and trading platforms. Data sources might include a centralized entity (like Binance’s API) or a decentralized protocol (like Chainlink).

- Optimistic Oracles (OO’s): rather than conveying pricing data, OO’s are able to transmit any type of “truth”. Someone may request an answer (“who won last night’s sports game?”) and someone else proposes an answer, but must stake collateral at the same time. Anyone may dispute their given answer, and if proven wrong, the person who proposed the question has their collateral taken. Check out my blog post that describes in greater depth how OOs work! UMA is the leader of this category.

On-Chain

Transactions that occur on a blockchain, and are therefore viewable using a network viewer such as EtherScan. The typical blockchain transaction that one might think of would tend to be on-chain.

Off-Chain

Transactions that occur on a private database. For example, centralized exchanges like Binance conduct transactions off-chain in order to keep transactions private and to avoid gas fees. dYdX, a popular synthetics protocols, has trades conducted off-chain to avoid gas fees and then has their validators update data on-chain at regular intervals.

Token

A digital asset that exists on a blockchain network and can be traded. They can be used for a variety of purposes, such as a unit of account, a representation of ownership, protocol governance, and so on. T

okens can be fungible or non-fungible. Fungible refers to assets considered equivalent and as such are exchangeable (e.g. a USD bill, or a Bitcoin), whereas non-fungible tokens are all unique (e.g. a piece of art in real life, or an NFT on the blockchain).

CoinMarketCap is a great resource for seeing tokens that exist.

Token Economics / Tokenomics

A big challenge in blockchain surrounds aligning stakeholder incentives. Accomplishing this requires studying token economics, a multidisciplinary field tied to economics, computer science, game theory, and psychology.

Components of this might include token distribution, the annual inflation rate, any burning of tokens, token utility, token governance, and much more. For example, some projects might give away plenty of tokens to bootstrap platform usage, whereas others may opt for strategies more likely to succeed in the long term. This is a complex field of research with a limited number of experts (for now!).

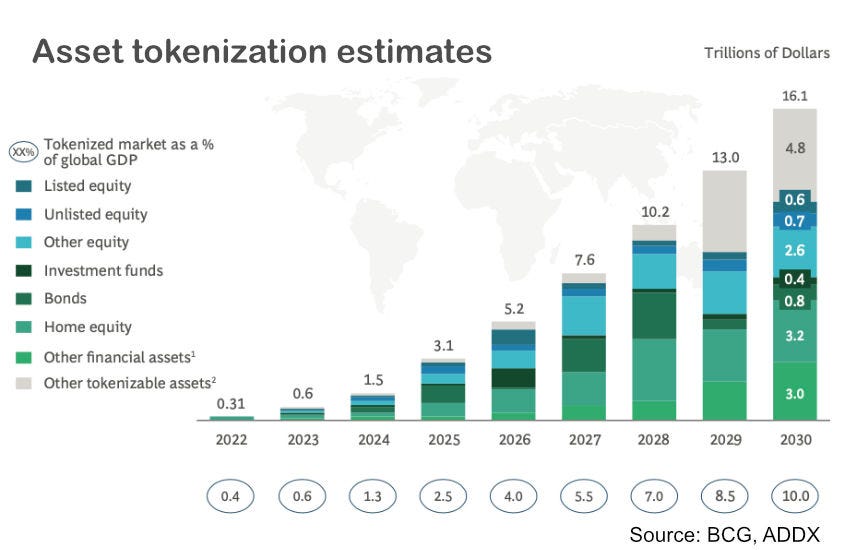

Tokenization

Tokenization refers to representing real-world assets on the blockchain. It’s one of the most promising areas of blockchain due to the ability to solve the illiquidity challenge of real-world assets. F

or example, Paxos has created gold tokens which enable anyone in the world (a global liquidity network) to buy any fraction of gold via blockchain. This differs from the regular purchase of gold, subject to high intermediary fees, security risks, transportation costs, lack of fractionalization, etc.

USD-backed stablecoins are an example of tokenization as well, as they represent real-world USDs. In the future, more and more assets will become tokenized, such as real estate, fine arts, account receivables, etc. In the context of real estate, anyone could purchase a fraction of a real estate investment and have cash flow automatically distributed to them via smart contracts.

Testnet

Protocols don’t want to just launch right away without adequate testing. Testnets are great for having users test out the protocol in a safe environment prior to the mainnet launching. Usually a “faucet” provides users with tokens that they can then use to interact with the protocol. Incentives are often used to reward those that interact with a given testnet.

Token Standard

Each blockchain has smart contract standards which basically dictate the technical specifications required in order to be compatible within the network. They make sure that tokens can easily be exchanged or deployed within different dApps, which could get messy if everyone uses different coding standards.

Fungible tokens on Ethereum are of the ERC-20 token standard, whereas NFTs rely on the ERC-721 type. ERC refers to Ethereum Request for Comment and refers to technical documents outlining how to develop smart contracts, such as sets of code functions.

Total-Value-Locked

This is the most common metric for assessing a DeFi protocol’s size and adoption. It’s kind of like market capitalization in the world of stocks and it measures the total value of assets that are “locked” into the smart contracts of DeFi protocols. For example, on Lido this might be the total value of ETH that is staked. Or on MakerDAO, the total amount of cryptocurrencies that are deposited into the protocol in order to mint $DAI stablecoin. The total DeFi market’s TVL is currently ~$40B, down significantly from its peak of ~$170B, but still up an incredible amount in relation to before “DeFi Summer” of 2020 where TVL increased dramatically.

Consider liquid staking, where you deposit ETH and receive stETH. This would in a sense be double-counting, so often these types of protocols are excluded from the market’s total TVL count. This is shown in the below photo.

In fact, Solana’s TVL was massively inflated last bull run because users double-stacked tokens through a web of interlocked applications. It’s an interesting story — check it out here!

Roll-Up

I mentioned that Layer 2’s bundle together a bunch of transactions (TXs) and send them to a Layer 1 as a single TX in order to scale a network. This “roll up” process can be divided into two main categories:

- Optimistic Roll Up: it’s assumed that all the TXs sent are valid, unless proven otherwise. Optimism, Arbitrum, and Metis use this.

- Zero-Knowledge (ZK) Roll Up: ZK technology is advancing like crazy and is both very interesting, and very confusing. Basically you can use complex mathematics to prove that something is valid without sharing its information. So I can prove that all TXs were valid without sharing their data. Here’s a thought experiment: if I have the “Where’s Waldo?” game, could I prove to you that I know where he is without actually pointing to him? One way to do this could be to get a big sheet of paper, cut a small hole in it, and move the Where’s Waldo page until you can see him through the small paper. I’ve proven I know where he is without revealing his location!

Rust

An alternative programming language to Rust that is used by blockchains such as Polkadot, Solana, NEAR, Avalanche, and many more.

Sidechain

A blockchain attached to a main blockchain enables assets to be transferred between the two. An example would be RSK and Bitcoin. Similar to a Layer 2, the goal is to scale a Layer 1, but some differences exist.

A sidechain is a blockchain itself, whereas a Layer 2 handles a bunch of transactions off-chain and sends them on-chain as a single transaction. Layer 2’s also rely on the security of the main chain, whereas sidechains have their own consensus.

Slippage

Liquidity is a big issue in DeFi and this is evident through slippage. When there is not enough liquidity to execute a trade, the final trade price may end up being different than expected. For example, if I wish to trade $500,000 in stablecoin A for the equivalent in stablecoin B, there may not be enough liquidity of stablecoin B which forces me to pay more for the trade to execute. This might be labeled as “price impact” such as below.

Solidity

The programming language used on Ethereum, and compatible with the Ethereum Virtual Machine. Other blockchains such as Binance Smart Chain use Solidity as well.

Stablecoins

Stablecoins are blockchain-native tokens pegged to other stable assets, enabling the benefits of blockchain technology without the volatility. For example: a) instantaneous remittances across the globe, b) accepting payments without having to pay the usual 2–3% payment processing fees, or c) purchasing USD stablecoins to hedge against local inflation. The benefits of stablecoins go on and on.

Most stablecoins are pegged 1:1 with U.S. Dollars, although gold-backed stablecoins exist, and a Euro stablecoin was recently introduced as well. I mentioned earlier that MakerDAO enables the minting of $DAI, which is also pegged to the USD. This type is collateralized by crypto, whereas the most widely adopted form of stablecoins are USD-backed, meaning redeemable for their equivalent in U.S. Dollars.

I suggest spending 10 minutes learning about Circle’s incredibly popular $USDC stablecoin.

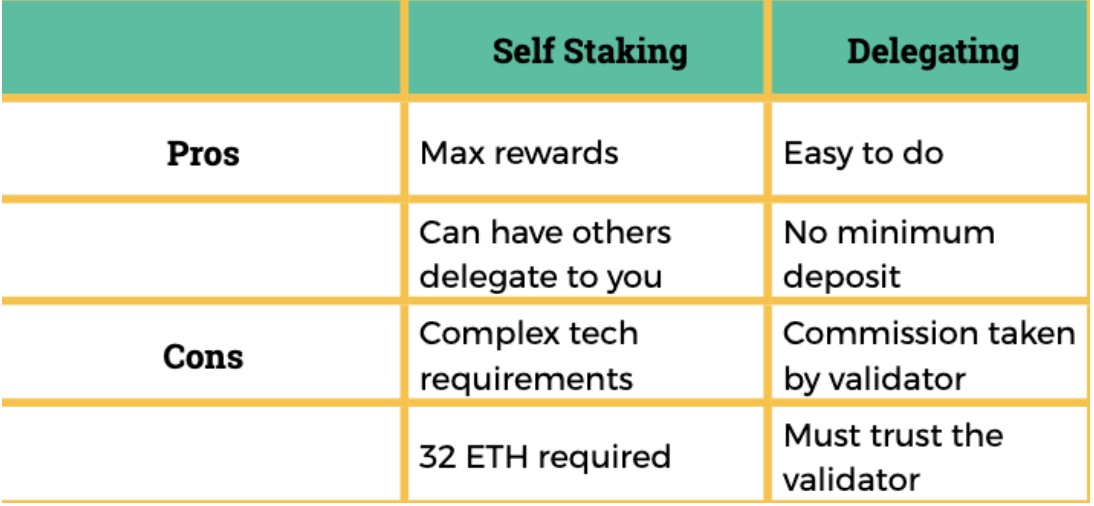

Staking

Proof-of-stake blockchain systems have validators who validate transactions, meaning they put together each block of data and make sure they’re valid. Being a validator is therefore a big task, so they’re required to deposit a large amount of the blockchain’s native token (e.g. ETH for Ethereum) as collateral. This aligns incentives as they’re now interested in seeing the network succeed (because they own so much), and also acts as collateral should they mess up. This process of depositing a token as collateral is known as staking, and the process of one’s stake being taken away as punishment is known as slashing.

Sybil Attack

Because blockchain is pseudonymous, it’s possible that a malicious actor can create various fake identities in order to attack a network. For example, they could spread misinformation, or manipulate a voting process.

Synthetics

Synthetics are basically tokenized derivatives, meaning on-chain representations of derivatives. They therefore track the price of an underlying asset, such as another cryptocurrency, commodity, or stock The most popular project is Synthetix, and these types of protocols are becoming increasingly integrated with the real world. An interesting example is Nexus Mutual, a DeFi insurance platform, with synthetic assets that track the prices of various insurance coverages.

Utility Token

Whereas a governance token gives voting rights, a utility token provides holders with access to specific services or functions.

Validator

In PoS blockchains, validators validate transactions and add them to the blockchain. They must first purchase and deposit a large amount of the network’s token (a minimum of 32 ETH on Ethereum) as collateral in order for the opportunity to be a validator, and to incentivize good behaviour on their end.

When the average person wishes to stake, they’re in reality giving their tokens to a validator who stakes on their behalf, in a process known as delegating.

So a validator would stake funds themselves and receive funds from consumers, who are delegators. If a consumer has 32 ETH laying around, they could also technically self stake and become a validator.

In the context of a PoW blockchain like Bitcoin, miners are the validators as they validate transactions and blocks.

Yield Aggregator

These protocols can be thought of as dApps for yield farming, which I describe below. They aggregate liquidity and yield across various other protocols in order to provide users with the best yield possible, as well as access to advanced yield strategies.

Yield aggregators such as Yearn Finance and Beefy Finance have become quite popular due to their simplification of yield farming, as well as additional features such as asset rebalancing and asset insurance.

Yield Farming

Also known as liquidity mining. It essentially refers to DeFi users deploying funds in various ways in order to maximize their yield. This might entail being a liquidity provider, lending tokens out, staking, or using cryptocurrencies as collateral for loans in order to leverage up.

Many different strategies exist, but many risks exist as well. Those that are new should be well informed about rug pulls, impermanent loss, liquidations, and so on prior to engaging in yield farming.

Wallets

Cryptocurrencies are held in wallets, which can be categorized as either custodial or non-custodial. A custodial wallet entails having another party custody funds on your behalf, such as centralized exchanges like Binance which hold your funds. One advantage is that if you lose your password, it can be recovered. A non-custodial wallet means that the user has total control of their own funds, although if they lose their seed phrase (usually 12 or 24 words), then their funds are gone for good.

Examples include MetaMask, Atomic Wallet, Kepler, and so on. These don’t tend to support every single blockchain network, so more than one wallet may be required.

Wrapped Token

Above I explained native tokens, which are good to understand prior to reading this. Wrapped tokens represent tokens on another blockchain, via a blockchain bridge.

For example, a smart contract can be deployed on both Bitcoin and Ethereum. On Bitcoin, it might hold 1 BTC locked up in a smart contract and then issue you 1 wrapped Bitcoin (WBTC) on Ethereum. This WBTC is redeemable for the BTC on the Bitcoin network, so it therefore has value in itself (as a sort of derivative) and tracks the price of Bitcoin.

They’re important for interoperability between blockchains, as it can be timely and costly to natively issue a token onto a new blockchain. They also have other benefits, such as increasing the liquidity of a token, and enabling access to a given token regardless of the blockchain that it’s native to.

— — — –

That’s all — did I forget anything? If so, let me know!